What is the pay cycle change?

Beginning January 01, 2022 all employees who are now paid on the current pay cycle basis will transition to an arrears pay cycle. This means employees will be paid after the actual time worked.

Recognized as a best practice at universities and businesses across the country, the arrears pay cycle will eliminate the perception of “guessing” employees now have when filling out timesheets before the end of the pay period. It will also enable St. Mike’s to decrease payroll errors, provide more accurate and timely reporting of employee benefits, reduce the amount of employee time spent completing and correcting time sheets, and ensure a more efficient, and paperless payroll process.

What is the 2022 payroll schedule?

You can view the payroll schedule for 2022 here.

Who is affected by the transition?

All salaried University of St. Michael’s College, PIMS and CCBI employees will be transitioned to an arrears pay cycle on January 01, 2022.

What will happen to my pay cheque?

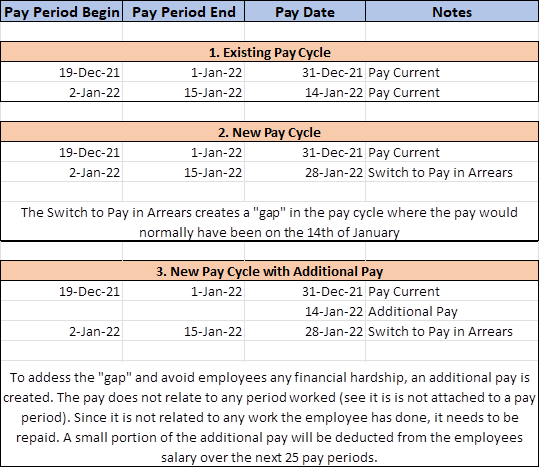

To transition to payment in arrears, salaries for the pay period January 2 to January 15, 2022 will be paid to you on January 28, 2022.

Will I be paid on January 14, 2022?

You will not receive a regular pay cheque on Jan. 14; however, to prepare for the smooth transition from the current pay cycle to the arrears pay cycle, St. Mike’s will offer a one-time, additional pay to you on January 14, 2022—the same gross amount as your Dec. 31, 2021 pay cheque. All regular deductions will be deducted from your pay.

This additional pay is not earned income – it is an additional payment to avoid any cash flow hardship during the transition to “payment in arrears.” The additional pay is designed to help you pay for usual expenses that would normally be covered by your regular pay cheque after taxes and withholdings.

Transition payments will be automatically repaid as a deduction over the next 25 pay periods (4% per pay).

If you separate from employment with USMC before having fully repaid the transition payment, the remaining unpaid balance of the “additional pay” will be deducted from your final pay cheque.

Do I have to pay back the transition payment?

Yes.

Can I choose not to transition to a pay-in-arrears schedule?

No. All employees who are salaried under the current pay cycle will be transitioned to the pay-in-arrears cycle.

Will my salary be reduced?

No. This transition will not result in a salary reduction. Pay cheques are simply moved to a pay-in-arrears cycle. In 2022, T4s will appear to show a decreased net pay as the result of a 25 period pay schedule, but you are not being paid less than your entitlement during the transition year. Moving to “payment in arrears” means that payment for your last 2022 pay period will be paid the first pay period of 2023.

How will I be paid after the transition?

Beginning with your January 14, 2022 pay cheque, you will continue to receive your pay cheque bi-weekly on Fridays. The only change is the lag – you will be paid two weeks after you have worked and reported the time for that payroll period.

How will I benefit?

You will no longer have to fill out timesheet prior to the end of the pay period. This eliminates any “guessing” that many employees now feel they must do. It also greatly reduces the number of timesheet corrections you will have to make.

The new pay cycle will decrease the likelihood of payroll errors, resulting in more accurate and timely pay as well. The new system will enable accurate reporting of your leave balances and accrued benefits. It should reduce the amount of time that University employees at all levels spend completing, approving, and correcting time sheet records and time off requests.

A paperless payroll system and improved operating efficiency for St. Mike’s benefits us all—and it’s one of the objectives outlined in the St. Mike’s 180 strategic plan.

Will the new pay cycle affect my sick and vacation entitlements?

No. Paid time off entitlements will be unaffected by the change. The system will allow employees and managers to better track these entitlements.

How will my federal, and provincial tax withholdings be affected by the transition payment?

These withholdings will not be affected. The transition payment is not considered a wage or earned income. You are only taxed on earned income; therefore, this transition payment would not qualify for taxation.

I am a new employee. How am I impacted?

If you are a new employee that starts or started in 2022: as you were not on the pay cycle coming into 2022, there is no “gap” in your pay as there was for existing employees. As such, there is no “additional pay,” and your pay is automatically on the pay in arrears cycle.

How do I know if I am a salaried employee?

Most employees are salaried employees. Salaried means you are paid a base number of hours per week. Even if you do a timesheet, you are likely salaried. Employees that are salaried include:

- Permanent Non-Union employees

- All USW staff

- Librarians and Faculty

Only hourly employees are not affected by the change, because hourly employees were already paid in arrears. Employees that are hourly include:

- Part-time staff

- Work study students

- Teaching assistants

- Writing Centre Instructors

I don’t understand the pay cycle change and the “additional pay.” Can you please give me the simple explanation?

The impact of the change in arrears can most easily be seen in the below chart:

Who may I contact with questions?

Questions may be directed to hr.stmikes@utoronto.ca and usmc.payroll@utoronto.ca.